Milton's Real Estate Landscape in October 2024

October 2024 Real Estate Update: Milton Area Insights

In October 2024, Milton's real estate market demonstrated sustained growth within the Greater Toronto Area (GTA). Home sales in Milton increased year-over-year, while new listings rose at a more gradual pace, offering promising news for prospective buyers and sellers in Milton’s housing market. A slight uptick in the average home selling price further reflects the ongoing stability in Milton real estate, making it an attractive option in the broader GTA landscape.

Buyers Re-Engaging with Milton's Real Estate Market

As the Bank of Canada moves through the initial stages of its rate-cutting cycle, the Milton real estate market has seen renewed interest. According to Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce, many buyers have moved from the sidelines and re-engaged with the market in October. Lower borrowing costs and relatively stable home prices have made housing in Milton and the wider GTA more accessible, enhancing affordability and encouraging buyer activity.

Strong Sales Growth in Milton Real Estate

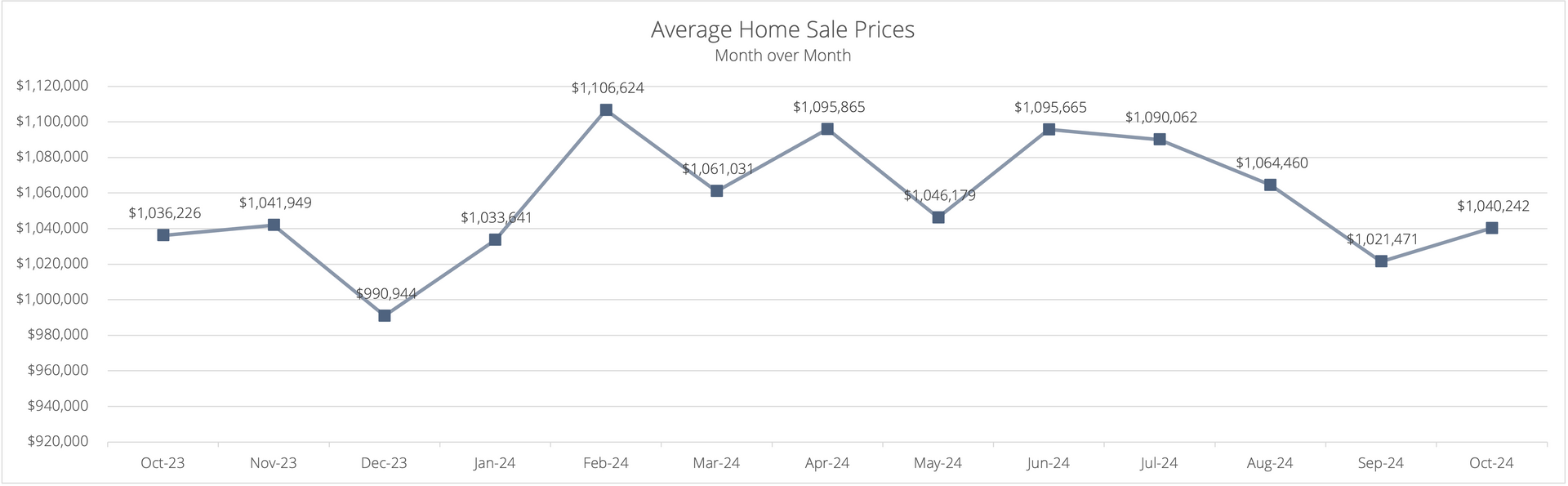

Milton REALTORS® reported a 53% year-over-year increase in home sales, with 163 properties sold through TRREB’s MLS® System in October 2024, up from 106 sales in October 2023. New listings also rose, with 163 homes added to the market, marking a 13% increase over last year. Month-over-month gains were also observed, with both sales and the average home price in Milton rising compared to September. The average selling price in Milton reached $1,040,242, representing a 0.39% increase over October 2023, showing steady growth within the GTA housing market.

Balanced Market Conditions Keep Price Growth in Check

While October saw tighter market conditions, the GTA’s inventory levels continue to provide prospective homebuyers with various choices. TRREB Chief Market Analyst Jason Mercer explains that this range of options helps to moderate price growth, benefitting both buyers and sellers. However, Mercer anticipates that as inventory is absorbed and new home construction falls behind population growth, selling price increases will likely accelerate moving into the spring of 2025, impacting home prices across Milton and the GTA.

Enhancing Affordability Through Policy Changes

Affordability remains a pressing issue in the GTA’s housing market, and policymakers are exploring ways to address it. TRREB’s CEO, John DiMichele, supports the Conservative Party’s proposal to remove the GST from new homes priced under $1 million. He views this as a crucial step for improving housing affordability, especially for first-time homebuyers in the GTA. DiMichele further suggests phasing out the rebate between $1 million and $1.5 million, rather than setting a hard cutoff, to better serve high-demand markets like the GTA and Vancouver. A similar provincial initiative could also bolster affordability across Ontario.

As Milton’s real estate market thrives, balanced market conditions, housing affordability, and a robust supply remain essential to meeting the needs of homebuyers and sellers in the GTA.

At Flowers Team Real Estate, we are dedicated to helping our clients navigate Milton’s vibrant real estate market with confidence. In a constantly changing real estate landscape, staying informed is essential for making smart decisions. Whether you're a first-time homebuyer, a real estate investor, or preparing to sell, our team provides the expertise and personalized support you need to achieve your real estate goals.

FContact Flowers Team Real Estate at [email protected] for expert guidance and insights into the Milton real estate market. Let us help you make your next move seamless, informed, and rewarding.

Disclaimer: Data and insights are based on TRREB's statistics for October 2024. Real estate market conditions can vary, so consult a professional real estate agent for advice tailored to your unique needs.

Flowers Team News